In Gemini’s latest “Weekly Market Update” released on August 11, 2023, several significant developments were highlighted in the cryptocurrency industry, marking a week filled with innovation and collaboration.

As of Friday, August 11, 2023, PayPal has become the first significant US financial firm to introduce its own US dollar-backed stablecoin, PayPal USD (PYUSD). The extension of PayPal’s crypto services, which currently include trading in Bitcoin (BTC), bitcoin cash (BCH), Ether (ETH), and Litecoin (LTC), includes this latest addition.

Stablecoins are now the “killer application” for blockchain, according to PayPal Senior Vice President and General Manager of Blockchain, Crypto, and Digital Currencies Jose Fernandez da Ponte, and are “something we cannot just sit out.”

Other Notable Market Updates

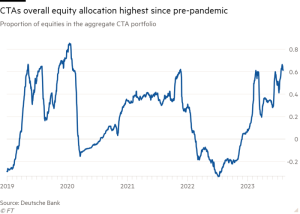

Inflation for July 2023 Was Lower Than Expected: Inflation for July 2023 was lower than expected, with both the headline and core consumer price statistics recording a minor rise of 0.2%. This results in annual increases for the corresponding categories of 3.2% and 4.7%. Market experts predict that interest rates will likely stay steady for the rest of the year as a result of the lower inflation statistics.

Coinbase’s Base Layer-2 Network Goes Live: Coinbase launched its Ethereum layer-2 network, Base, to the general public, with data showing $175 million USD locked on the blockchain as of Friday. This follows Coinbase’s better-than-expected second quarter earnings of $708 million USD in revenues.

Aptos Surges on Microsoft Partnership: Aptos (APT), a layer-1 proof-of-stake blockchain, saw a ~15% surge in price on Wednesday after announcing a partnership with Microsoft to work on AI and web3 products and services. The collaboration will leverage Microsoft’s Azure OpenAI services.

Bitcoin and Ether Continue Range Bound: Bitcoin traded in the $29k to $30k USD range for the second week, possibly boosted by PayPal’s stablecoin launch. Ether has been struggling to move back above its 100-day moving average of $1,850 USD.

Crypto Custody Explained

The update also touched on the importance of crypto custody, outlining different options for investors, including self-custody via private keys, partial custody with third-party assistance, and third-party digital asset custody. The latter offers high levels of security and is suitable for individual and institutional investors.

Image source: Shutterstock

+ There are no comments

Add yours