Bitcoin‘s bulls are demonstrating their might, driving the world’s premier cryptocurrency past the significant $26,000 benchmark.

Today’s live price of Bitcoin stands at $26,553, having experienced a slight uptick of less than 0.10% in the last 24 hours. With a trading volume of $6.6 billion in the same period, the enthusiasm around Bitcoin remains palpable.

Currently sitting atop the CoinMarketCap ranking at #1, Bitcoin boasts a formidable live market capitalization of $517 billion. The circulating supply remains robust at 19,488,087 BTC coins, inching closer to its ultimate cap of 21,000,000 BTC coins.

As investors and enthusiasts observe these promising numbers, the paramount question remains: will Bitcoin’s upward trajectory persist?

Critical Economic Events to Influence Bitcoin Price Dynamics Next Week

In the upcoming week, several critical economic events are poised to influence Bitcoin’s price dynamics, given the cryptocurrency’s correlation with macroeconomic factors.

On Wednesday, September 20th, all eyes will be on the Federal Reserve as it releases its Federal Funds Rate, currently pegged at 5.50%.

The same day, market watchers will keenly await the FOMC Economic Projections, FOMC Statement, and the subsequent FOMC Press Conference scheduled for 6:30 p.m.

Any dovish or hawkish stance can lead to significant volatility in traditional markets, which often trickles down to the crypto market.

The next day, Thursday, September 21st, will bring forth the Unemployment Claims data, with analysts forecasting a slight increase to 222K from the previous 220K.

Concluding the week on Friday, September 22nd, are the Flash Manufacturing PMI and Flash Services PMI, expected at 47.9 and 50.8, respectively.

These indices offer insights into the economic health and, if deviating from expectations, can indirectly sway Bitcoin’s price by affecting market sentiment.

Bitcoin Price Prediction

Upon technical examination of Bitcoin’s current position, it displays a cautious bearish trend.

Presently, Bitcoin hovers just above the $26,500 support level, formerly a resistance, and remains stable close to the $26,800 resistance, suggesting a double-top pattern.

There’s a descending trend line around $26,750 that may restrict Bitcoin’s upward trajectory. If Bitcoin breaks this trend line, it could target the $27,000 level.

Beyond this, the $27,600 level stands as a significant resistance. Clearing this could pave the way to the $28,000 mark.

On the flip side, if Bitcoin doesn’t surpass the $26,750 trend line, it might pull back towards $26,600 or possibly retest the $26,000 support.

This movement could stimulate an increase in selling, potentially driving the price to around $25,250.

Notably, several technical indicators, such as the 50-day exponential moving average and the relative strength index, signal a potential bullish momentum.

Investors should closely watch the $26,500 level, as it may serve as a key pivot point. Prices above this level could indicate buy signals, while prices below might indicate sell signals.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

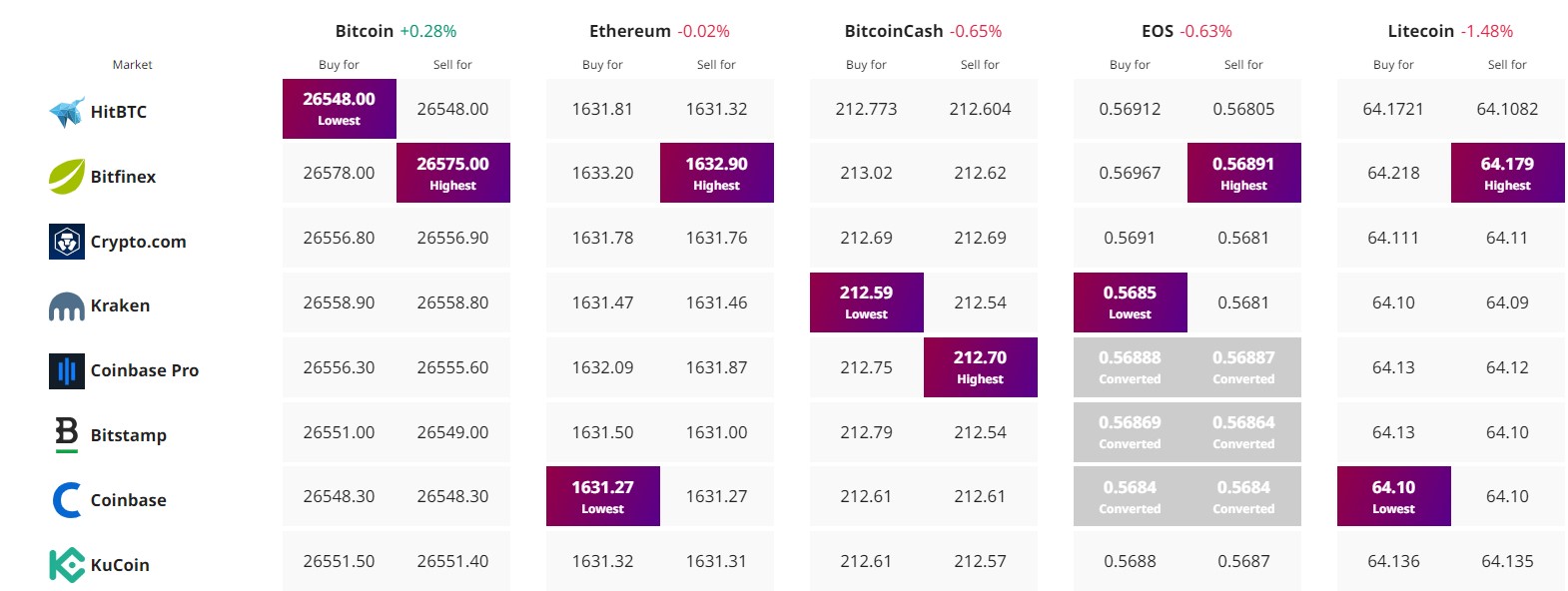

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

+ There are no comments

Add yours