Bitcoin, the pioneering cryptocurrency, faced a slight setback as it dipped to $34,146, marking a nearly 1.75% decline this Friday. This downturn comes amidst a flurry of activity in the crypto sphere.

The US Securities and Exchange Commission (SEC) has been flooded with eight to ten potential Bitcoin ETF product submissions, hinting at an evolving landscape.

Meanwhile, across the pond, the UK government has greenlit legislation that empowers law enforcement to seize Bitcoins involved in illicit activities. Not to be overshadowed, FTX makes its second significant stride by channeling millions in cryptocurrency to centralized exchanges, underscoring the dynamic shifts in the digital currency arena.

US SEC Flooded with Bitcoin ETF Proposals

There is growing anticipation for the approval of a spot Bitcoin exchange-traded fund (ETF) as the US Securities and Exchange Commission (SEC) is currently reviewing eight to ten applications for Bitcoin exchange-traded products (ETPs). Consequently, investors have been acquiring Bitcoin in anticipation of the SEC’s decision.

The expectation is that the approval of a spot Bitcoin ETF, which would offer direct listed product exposure to cryptocurrencies, is on the horizon.

US SEC has 8-10 filings of possible bitcoin ETF products

— The Globe and Mail (@globeandmail) October 26, 2023

As of now, the SEC has only approved ETFs tied to Bitcoin futures contracts. Prominent firms that have submitted applications for Bitcoin funds include ARK Invest, BlackRock, Bitwise, WisdomTree, Fidelity, and Invesco. The market’s apprehension regarding these upcoming ETF decisions might be contributing to the recent dip in Bitcoin prices.

UK’s New Stance: Seizing Illicitly Used Bitcoins

In the UK, new legislation has empowered authorities to seize and freeze cryptocurrencies, such as Bitcoin, linked to illicit activities. The Economic Crime and Corporate Transparency Bill, introduced in September 2022, received royal approval on October 26, 2023, following its successful passage through all legislative phases. This law enhances the powers of law enforcement agencies to combat cryptocurrency-related crimes, encompassing areas like drug trafficking, cybercrime, fraud, and terrorism financing.

Significantly, this legislation permits the retrieval of cryptocurrency assets even in the absence of a formal conviction. This feature is vital in dealing with cybercriminals who often operate from remote locations. The UK government’s move aligns with its broader objective to intensify cryptocurrency regulations and curb its misuse.

UK passes bill to enable authorities to seize Bitcoin used for crime

— Digital Assets Daily (@AssetsDaily) October 26, 2023

Nevertheless, the intensified regulatory oversight and the potential for asset confiscation may unsettle some stakeholders in the cryptocurrency market. This could introduce volatility, possibly prompting some investors to offload their BTC holdings due to the increased uncertainty.

FTX’s Strategic Push: Channeling Crypto to Centralized Platforms

The estate overseeing FTX’s bankruptcy has executed substantial Bitcoin transactions to major exchanges. Following an $8.6 million transfer to Binance, an additional transfer amounting to around $20 million was made. Peckshield, an on-chain analytics and intelligence firm, detected this movement, which included a transfer of over 470,000 Solana (SOL) tokens, equivalent to $15 million, to platforms like Binance. Other cryptocurrencies such as ETH, COMP, and RNDN were also moved, with Coinbase receiving $2.5 million in ether.

While the exact purpose of these transfers remains unclear, they might have been initiated for trading or liquidation purposes on these exchanges. Furthermore, FTX’s creditors have secured assets. As the bankruptcy process progresses, the estate is formulating its final proposals. Given the magnitude of these crypto transactions and potential market concerns regarding FTX’s status, this development could have contributed to the recent dip in Bitcoin’s value.

Bitcoin Price Prediction

As the week draws to a close, the dynamic world of Bitcoin presents yet another intriguing chapter for investors and market analysts alike. Currently trading at a price of $34,024, Bitcoin has encountered a 2.00% dip over the past 24 hours. This recent movement, set against a 24-hour trading volume of a remarkable $19 billion, underscores the volatility and unpredictable nature of the cryptocurrency market.

Notwithstanding its recent dip, Bitcoin retains its stronghold as the top-ranked asset on CoinMarketCap, boasting a substantial market cap of $664 billion. The available circulating supply is inching closer to its cap, with 19,525,006 BTC coins in circulation out of a potential 21,000,000 BTC coins.

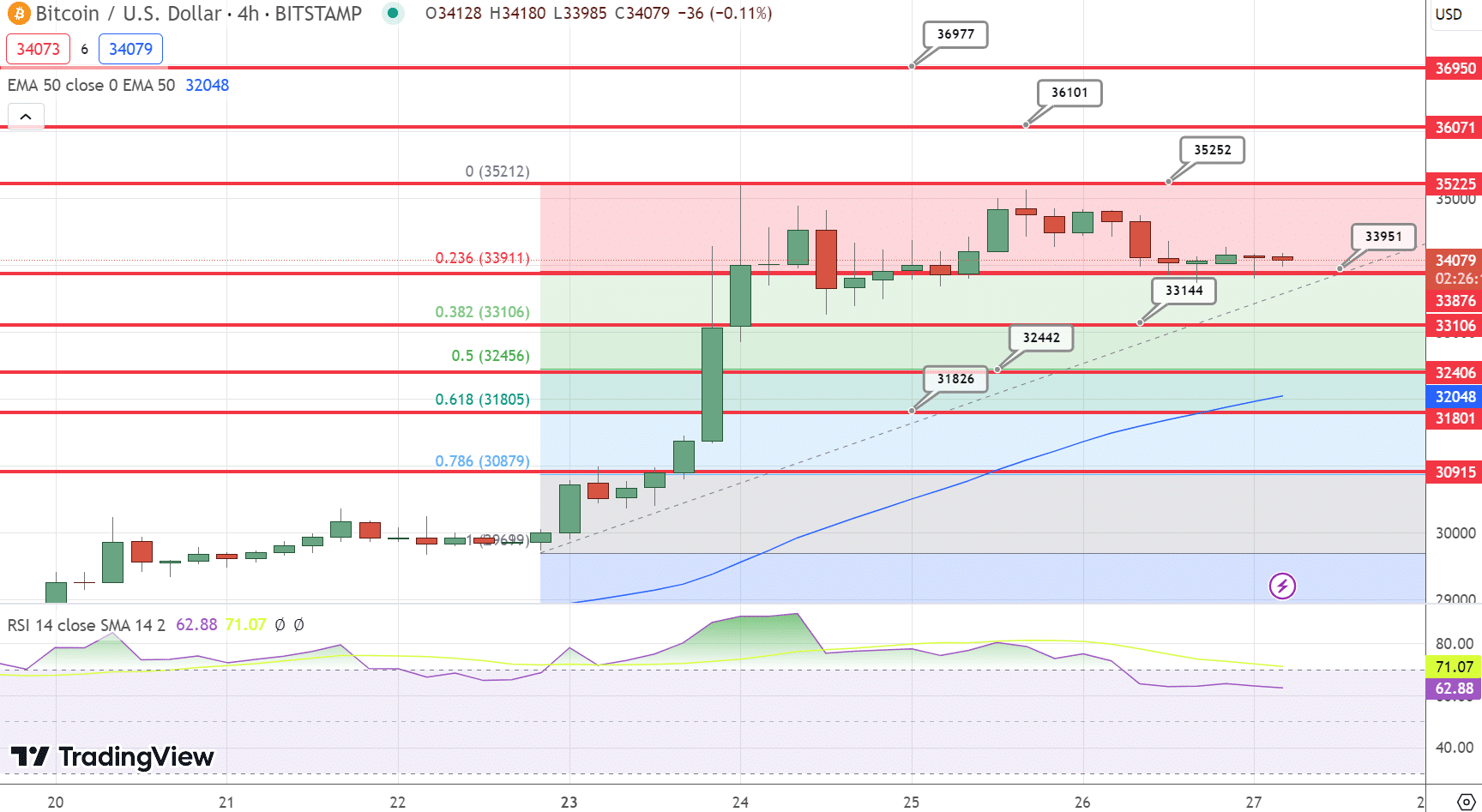

Delving deeper into the technicals, the 4-hour chart paints a vivid picture. The pivot point rests at $32,424, providing a critical juncture for potential price movement. On the bullish side, investors should be eyeing the immediate resistance at $34,480, followed by more ambitious targets at $36,536 and $38,560. Conversely, for those with a bearish outlook, immediate support lies at $31,217, with subsequent cushions at $29,160 and $27,985.

Technical indicators further enrich our analysis. The Relative Strength Index (RSI) stands at 64, hinting at a slightly bullish sentiment as it remains above the midline. The 50-Day Exponential Moving Average (EMA) at $32,043 serves as a beacon for traders, indicating a short-term bullish trend as the price hovers above this mark.

Chart patterns, including a series of Doji candles just above the 23.6% Fibonacci retracement level, suggest a prevailing sense of indecision among investors. Immediate support is anticipated around the 38.2% Fibo mark of $33,100.

In conclusion, while the immediate trend for Bitcoin leans bullish above the $33,900 mark, inherent market volatility warrants cautious optimism.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments. Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

+ There are no comments

Add yours