Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favorite stories in this weekly newsletter.

The UK economy rebounded more than expected in November driven by growth in the services sector, according to official figures that ease fears of a technical recession.

Gross domestic product grew 0.3 per cent between October and November, following a 0.3 per cent contraction between September and October, the Office for National Statistics said on Friday. That was stronger than the 0.2 per cent expansion forecast by economists polled by Reuters.

Grant Fitzner, ONS chief economist, said the rebound in GDP had been “led by services with retail, car leasing and computer games companies all having a buoyant month”. Strong Black Friday sales and fewer strikes also helped.

After the UK economy marginally contracted in the three months to September, Friday’s data raises hopes it will avoid shrinking in the final quarter of 2023. Some economists define two consecutive quarters of falling GDP as a technical recession.

The pound was little changed against the dollar after the data release, trading down 0.04 per cent at $1.2753.

Ruth Gregory, deputy chief UK economist at research company Capital Economics, said the rebound in GDP in November “probably means the economy escaped a recession in 2023”.

However, Fitzner warned that “the longer-term picture remains one of an economy that has shown little growth over the last year”.

The economy largely stagnated through last year, reflecting the impact of high prices and interest rates on household finances and business activity.

In November, output was no higher than at the start of the year and was only up 0.2 per cent from the same month in 2022, laying bare the challenges for Prime Minister Rishi Sunak to “grow the economy” ahead of the election.

Responding to the figures, chancellor Jeremy Hunt said: “We have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”

But Rachel Reeves, Labour’s shadow chancellor, said: “The Conservatives have predicted over 14 years of economic failure that has left working people worse off. A decade of low economic growth has left Britain with the highest tax burden in 70 years.”

The Bank of England expects no growth in the final quarter of 2023 and that the economy will be “broadly flat” over coming quarters. But some economists are increasingly optimistic about the UK’s economic outlook as interest rate expectations have fallen on lower inflation.

Inflation was running at 3.9 per cent in November, down from 4.6 per cent the previous month and well below 11.1 per cent in October 2022.

Gregory said she expected the economy to move out of stagnation in the second half of 2024. “Recent big falls in market interest rate expectations, which have reduced rates on new mortgages and created more room for tax cuts, meaning that the economic recovery could start a bit sooner and be a bit stronger than we currently anticipate,” she said.

Martin Beck, chief economic adviser to the EY Item Club consultancy, said the “outlook is brightening” since, alongside lower inflation, “recent falls in wholesale gas prices point to a sizeable cut in household energy bills in the spring”.

He added that “prospective support to the public finances from lower interest rates”, which are currently at 5.25 per cent, had increased the chances of further tax cuts in Hunt’s spring Budget on March 6.

According to the ONS, services output grew by 0.4 per cent in November and was the main contributor to the monthly growth in GDP. Strong growth in information and communication, retail trade, and professional and health services more than offset the contraction in education and financial services.

The ONS said fewer strikes compared with previous months may have contributed to the increase in monthly growth in the health, transport and film production sectors.

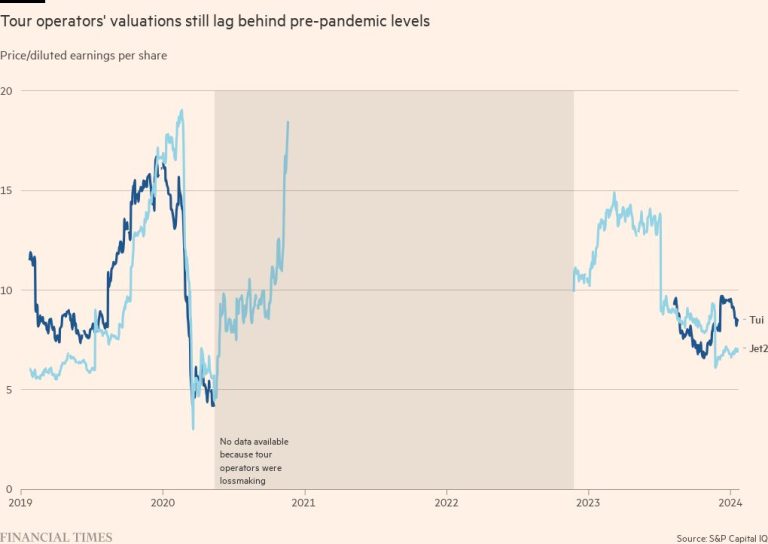

Output in consumer-facing services, such as restaurants and travel agencies, grew by 0.6 per cent in November, following four consecutive monthly falls, but remained 5.8 per cent below pre-pandemic levels.

This is in contrast with all other services, which were 7.5 per cent above their pre-February 2020 levels.

Production output grew by 0.3 per cent in November, driven by pharmaceuticals. The construction sector shrank by 0.2 per cent, following a 0.4 per cent contraction in October, on the back of bad weather and high interest rates.

+ There are no comments

Add yours